In which of the following situations will an adverse selection problem likely become more serious. The following information is common to the two parts.

Government restricts the use of certain underwriting factors and mandates the purchase of that insurance Government.

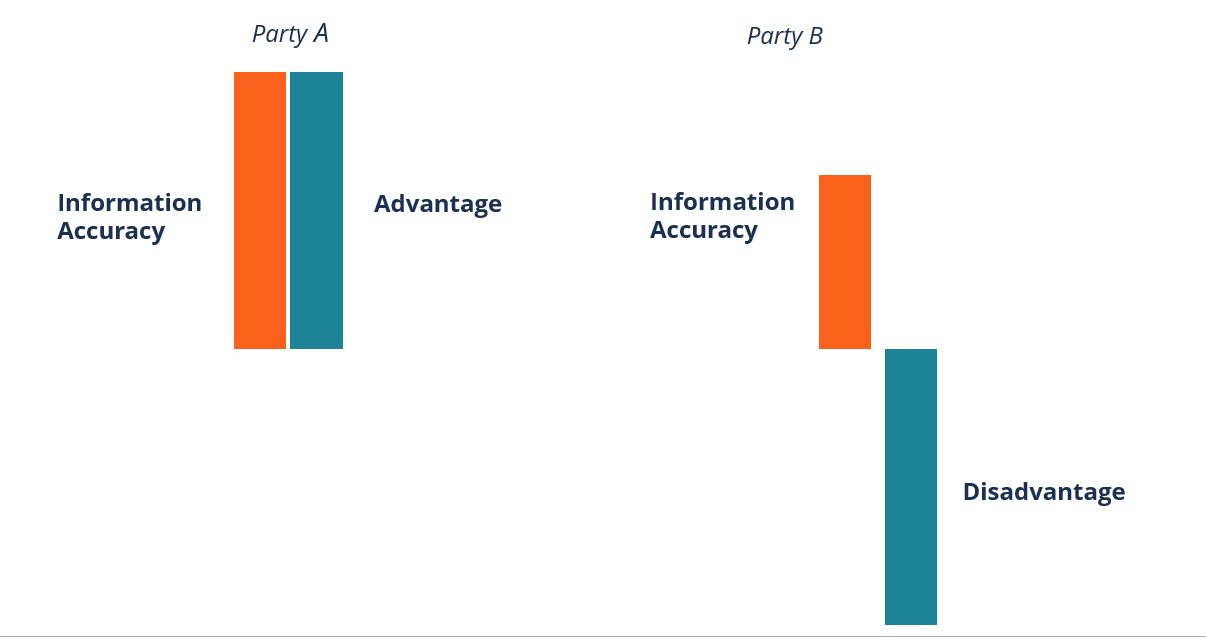

. Suppose that it is shows the market for an insurance product. Adverse selection may occur when a buyer intends to purchase a product or service from a seller but the seller has more information about the product. Adverse selection is a situation where the principal and the agent have conflicting preferences and the agents behaviour cannot be perfectly observed.

Adverse selection describes the situation that occurs when A. People have perfect information B. Helping someone out of the blue because of empathy.

Business Operations Management QA Library In which of the following situations will an adverse selection problem likely become more serious. Taking advantage in an economic contract or trade of possession of undisclosed information is known as adverse selection. The situation becomes biased when participants from one of the parties who know more than the other exploit this private information to act optimally based on their own self.

Adverse selection results when one party makes a decision based on limited or incorrect information which leads to an undesirable result. Answer which happens moral hazard or adverse selection or nothing happens under each of the following situations. Actions that were expected to happen do not occur.

Have more information than used car sellers. Question b You hire a substitute tutor for your sister and agree to pay 40 up front. The main difference is when it occurs.

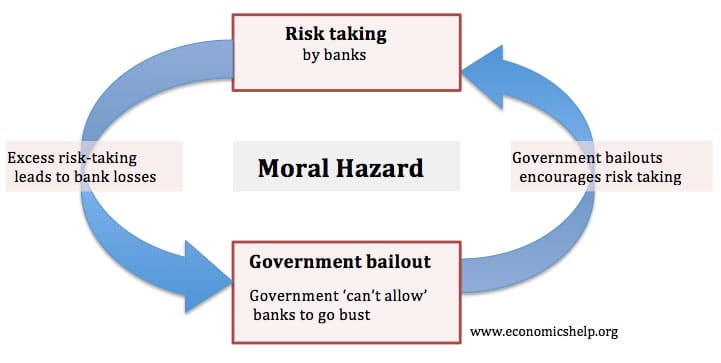

In a moral hazard situation the change in the behavior of one party occurs after the agreement has been made. This opportunity has secondary effects. Adverse selection happens due to the following factors.

Note that different starting positions of the graph can result in different results. Adverse selection occurs when there is asymmetric information between a buyer and a seller before a deal. Adverse selection in health insurance happens when sicker people or those who present a higher risk to the insurer buy health insurance while healthier people dont buy it.

In a situation where an externality occurs the third party refers to those who. Which of the following are situations in which governments likely to intervene in markets. Agency problem happens when management takes self-interested actions that are not in the interest of shareholders.

Adverse selection refers generally to a situation where buyers have information that sellers do not have or vice versa about product quality. Are not directly involved in the transaction or activity Refer to the graph above. Adverse selection occurs in the market for used cars because used car buyers.

A driver drives a car. The party without the information can take steps to avoid entering into an unfair maybe rigged contract perhaps by withdrawing from the interaction or a seller buyer asking a higher lower price thus. The customer has initial wealth W 0 4 and will su er loss L 3 if state B occurs.

Tend to have more accidents than new car buyers. High-quality products are driven from the market by low-quality products due to imperfect information. That means one of the two parties usually the seller has more accurate.

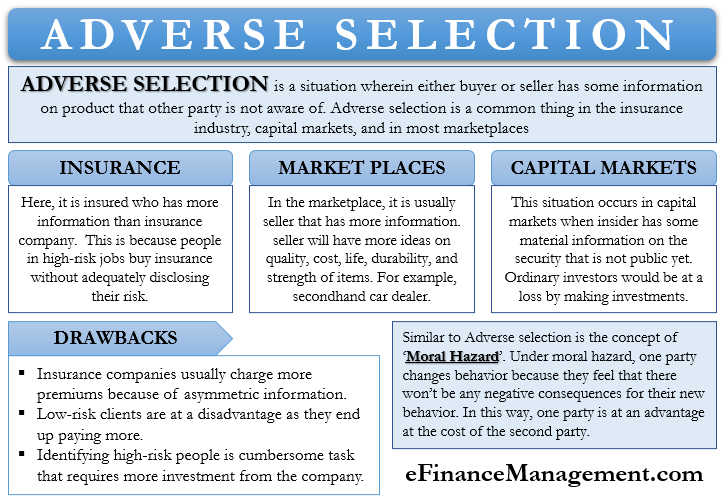

In the case of insurance adverse selection is the tendency of those in dangerous jobs or high-risk lifestyles to get life insurance. Therefore it is crucial to know the characteristics and differences between adverse selection and moral hazard to recognize these situations and react accordingly. It is a situation that arises when two engaging parties have different or asymmetric information.

However in adverse selection there is a lack. The customer is an expected utility maximizer with a. Recruiter inability to evaluate the candidate core competencies level of the offered job post.

The supply curve will shift to. Have less incentive to maintain the value of their cars than new car buyers. Adverse selection is a term commonly used in economics insurance and risk management.

29 Adverse selection is a situation in which one party to an economic transaction has less information than the other party. There are two states G and B where G is the no-loss state and B the loss state. If something happens to heighten the adverse selection problem in this market then.

Your answer must cover all potential scenarios. In each of the following situations is adverse selection the principal-agent problem or moral hazard at work. Adverse selection can also happen if sicker people buy more health insurance or more robust health plans while healthier people buy less coverage.

Adverse Selection between Buyer and Seller. Adverse selection happens when one side of a deal has more information than the otherwhen there is a state of asymmetric information as described above. Such a situation places the buyer at a disadvantage since they are entering into an agreement with a seller who may not willingly disclose all the information about the.

Part a is about moral hazard and part b about adverse selection. Which of the following are effects of adverse selection on the insurance industry. By contrast moral hazard is when one side provides misleading information and when protected from risk is freed up to behave more recklessly than they would without this protection.

Question a You decide to use an online dating site but you are not entirely sure if the posted picture of your date is accurate. Moral hazard is a situation in which people or institutions behave more recklessly after which of the following happens. 20 marks Using graphs of the market for reserves explain and indicate what happens to the cash rate borrowed reserves and nonborrowed reserves in the following situations holding everything else constant.

30 One consequence of adverse selection in the market for used cars is that most used cars sold will be lemons.

0 Comments